Hidden Costs of Voting: Why Transparency Is Key to DAO Success

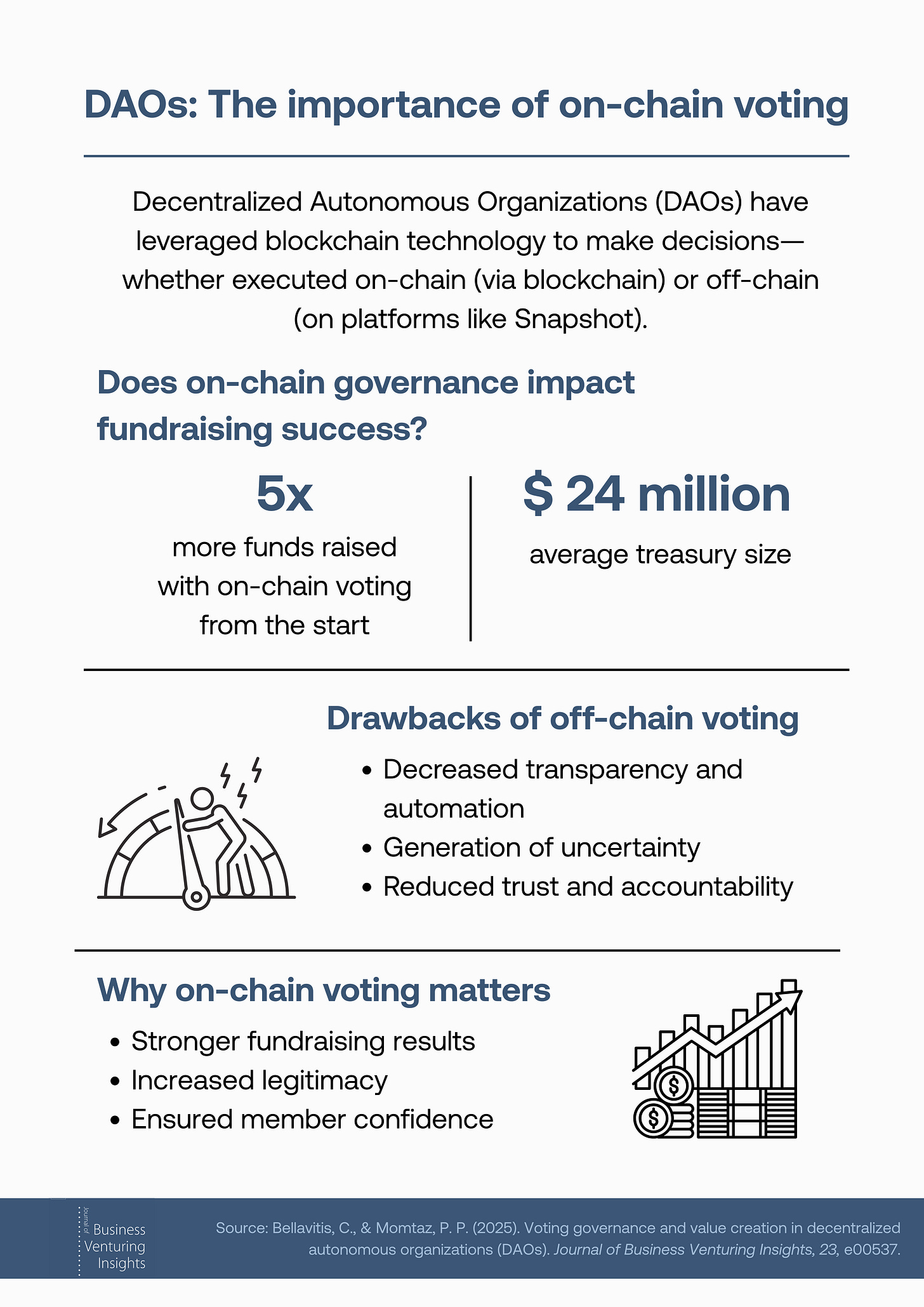

Decentralized Autonomous Organizations (DAOs) are rapidly emerging as a revolutionary organizational form in the blockchain world. They promise decentralized, transparent, and efficient governance without traditional hierarchical structures. But how DAOs make decisions—especially whether they vote on-chain (via blockchain) or off-chain (on platforms like Snapshot)—may dramatically impact their performance. Our study, published in the Journal of Business Venturing Insights, investigates how these governance choices affect DAO success, especially during early fundraising.

How we studied voting mechanisms in DAOs

We analyzed a unique dataset of 365 DAOs using data from DeepDAO, GitHub, and crypto market indicators. We compared DAOs using off-chain and on-chain voting systems, controlling for community size, coalition dynamics, and development activity. To address potential bias (only successful DAOs raise funds), we employed a robust two-stage econometric model.

What we found: Off-chain voting comes at a high price

DAOs that rely on off-chain voting raise significantly less money than those using on-chain systems. On average, the treasury size of off-chain DAOs is five times smaller. This "governance discount" becomes even steeper in DAOs with large communities, strong voting coalitions, or extensive developer teams—contexts where transparency and accountability are most needed.

Why this matters: Trust, not just tech, drives DAO value

While off-chain voting may save time and reduce transaction costs, our findings highlight a classic trade-off from Transaction Cost Economics (TCE): what you gain in efficiency, you may lose in trust and transparency. In DAOs—where code is law and members may never meet—transparent governance becomes a core asset. On-chain voting mechanisms help ensure that decisions are not only visible but enforceable, reinforcing community trust and encouraging greater financial commitment.

Takeaways for builders, investors, and policymakers

For DAO builders: Prioritize on-chain governance, especially if your community is large or your team is highly technical. Transparency isn't optional—it's strategic.

For investors: Scrutinize how governance is structured. Off-chain mechanisms may indicate hidden risks or concentrated control.

For policymakers: Our findings support the case for governance disclosure requirements in crypto markets. If voting shapes capital formation, transparency should be a regulatory concern.

Read the full paper here to find out more: https://www.sciencedirect.com/science/article/pii/S2352673425000241

Author Bios

Cristiano Bellavitis is an Associate Professor of Entrepreneurship at Stevens Institute of Technology and an editor at Entrepreneurship Theory and Practice. He studies digital strategy, entrepreneurial finance, and blockchain.

Paul P. Momtaz is an Associate Professor at the Syracuse University and a leading scholar in crypto governance and decentralized finance.